To start Internet banking with Central Bank of India, visit their official website and navigate to the online registration page. Fill out the required information accurately.

In today’s fast-paced digital world, the convenience and accessibility of Internet banking have revolutionized the way we manage our finances. Central Bank of India offers a seamless online banking experience, allowing customers to access their accounts, make transactions, and monitor their finances from the comfort of their own home.

By following a simple registration process, customers can unlock a world of banking convenience at their fingertips. In this guide, we will explore the step-by-step process of how to start Internet banking with Central Bank of India and all the benefits it has to offer.

Credit: timesofindia.indiatimes.com

Registration Process

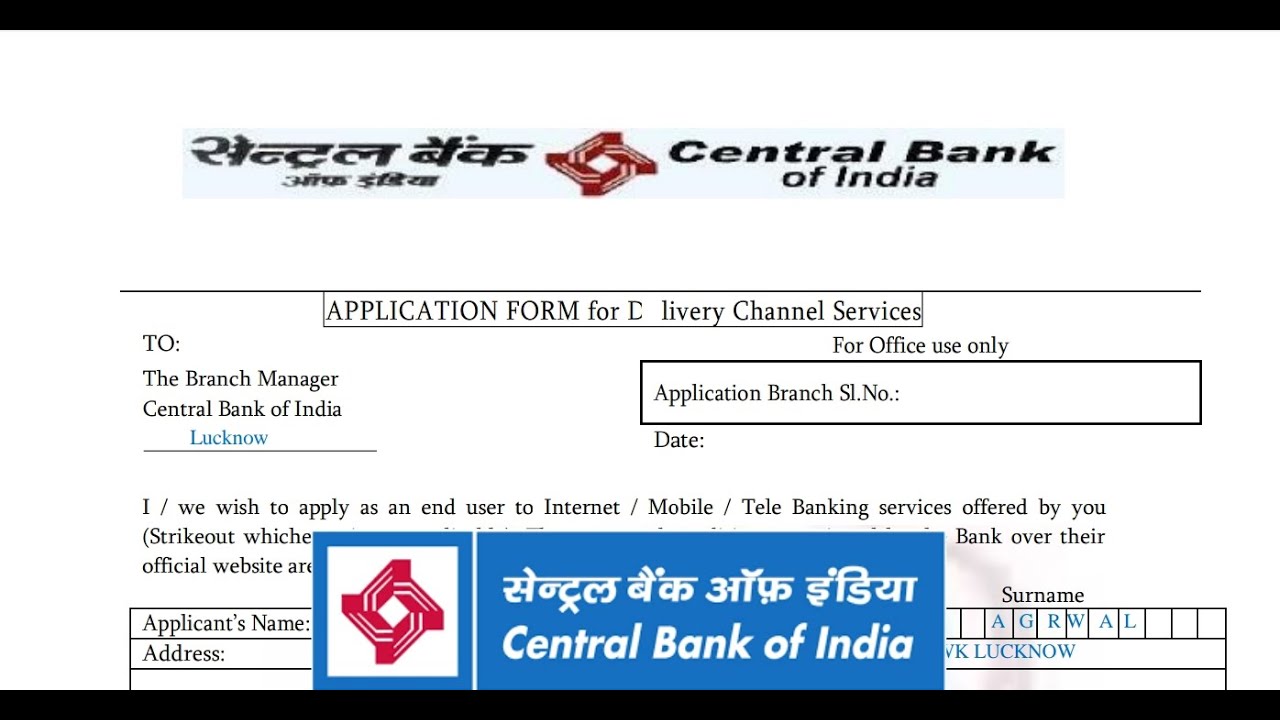

To start internet banking with Central Bank of India, you can register online through the bank’s website. Provide the necessary details and set up your login credentials to access your account securely. Additionally, you can opt for offline registration by visiting your nearest branch. Complete the registration form and submit the required documents to initiate the process. The bank staff will guide you through the registration procedure, ensuring a smooth transition to internet banking services.

Activation Of Internet Banking

To activate Internet Banking in Central Bank of India, follow these simple steps:

Confirmation Process

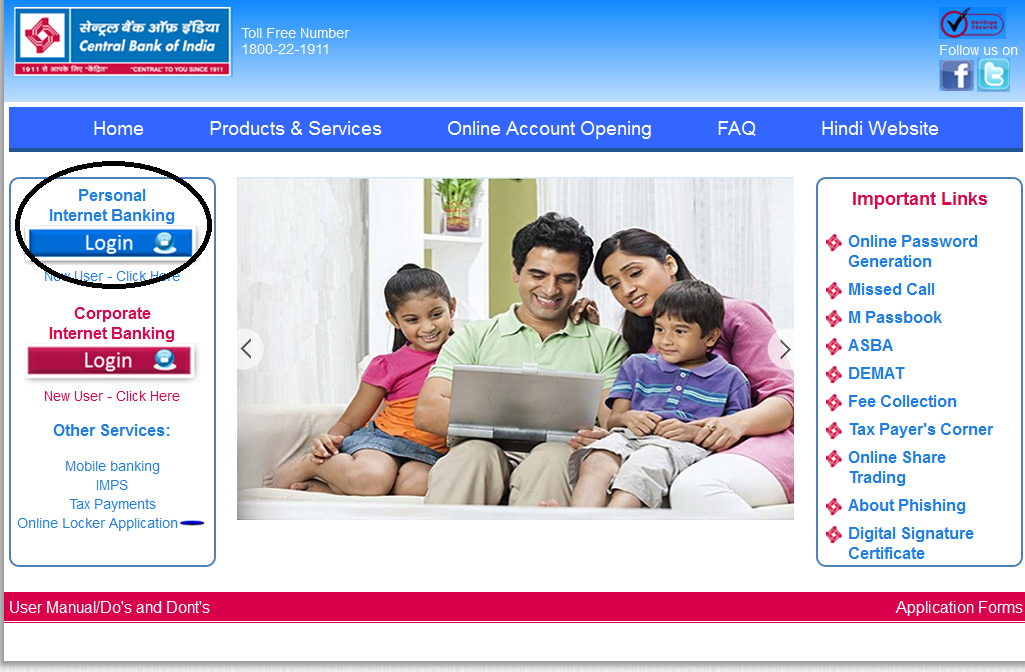

1. Visit the official website of Central Bank of India.

2. Click on the “Internet Banking” link.

3. Select the “Register” option.

4. Fill in the required information, including your account details.

5. Choose a unique username and password for your Internet Banking account.

6. Confirm your details and submit the registration form.

7. You will receive an activation link on your registered email address.

8. Click on the activation link to complete the process.

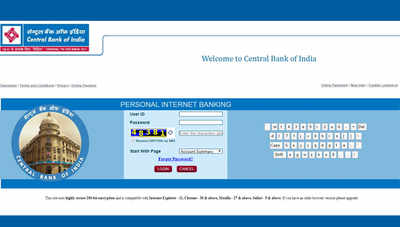

Login Credentials Setup

1. After activating your Internet Banking account, go back to the official website.

2. Enter your username and password in the login section.

3. Click on the “Login” button to access your account.

4. You may be prompted to set up additional security measures, such as OTP (One-Time Password) verification.

5. Follow the instructions provided for OTP setup.

6. Once you have completed the setup, you can now securely log in to your Internet Banking account at any time.

Navigating Internet Banking

Discover the simple steps to start internet banking with Central Bank of India. Access the official website and navigate to the registration section. Fill in the required details, verify your identity, and create a secure login to begin managing your finances conveniently online.

| Starting Internet Banking with Central Bank of India is simple. |

| Account overview: Log in to your account to view transactions. |

| Fund transfers: Easily transfer money between your accounts or to other beneficiaries. |

| Bill payments: Set up bill payments for utilities, loans, and more conveniently online. |

Credit: www.youtube.com

Security Measures

Discover the essential security measures to follow when starting internet banking with Central Bank of India. Ensure the safety of your online transactions and protect your personal information with these expert tips.

| When starting internet banking with Central Bank of India, ensure you use secure connections. |

| Two-factor authentication provides an extra layer of security for your online transactions. |

Mobile Banking Integration

Starting internet banking in Central Bank of India is a seamless process that requires mobile banking integration. Linking your mobile number to your bank account is the first step towards enjoying the convenience of internet banking. To do this, download the official mobile banking app provided by Central Bank of India on your smartphone. Once you have installed the app, follow the instructions to register your mobile number with your bank account.

By linking your mobile number, you will be able to receive important notifications, updates, and security alerts directly to your device. This ensures that you stay informed about any activity related to your bank account. Additionally, the mobile banking app offers a range of features such as fund transfers, bill payments, balance inquiries, and more, all at your fingertips. With the growing popularity of internet banking, it’s essential to have the convenience of mobile banking integration for easy access to your Central Bank of India account.

Troubleshooting

When starting internet banking with Central Bank of India, you may encounter common issues and solutions. If facing problems, reach out to customer support for assistance.

Credit: www.centralbankofindia.co.in

Conclusion

To wrap up, starting internet banking with Central Bank of India is a straightforward process that offers convenience, security, and a range of services. By following the steps outlined in this guide, you can take advantage of facilities such as fund transfers, bill payments, and more, from the comfort of your own home.

Embrace the digital age and experience the ease and efficiency of internet banking with Central Bank of India today.